“The trouble with the world is not that people know too little; it’s that they know so many things that just aren’t so.” —Mark Twain

Quick Answers: How Much Will I Actually Save With No Taxes On Overtime?

- You’ll still pay Social Security and Medicare (FICA) tax on every single overtime dollar you earn.

- The “no tax” rule only reduces your federal income tax. State taxes could be impacted, and payroll tax stays the same.

- You won’t see this change in your paycheck right away. It’ll show up when you file your 2025 tax return in early 2026.

- The deduction is capped: up to $12,500 (single) or $25,000 (married filing jointly) in overtime pay, and it phases out for higher earners.

When you’ve been pulling long shifts and watching your paycheck disappear to Uncle Sam, the possibility of getting more in your pocket from those extra hours feels like a huge win.

But let’s slow down.

Yes, there’s a real benefit to the OBBBA’s no taxes on overtime rule. But it doesn’t mean the overtime work you clocked at your Modesto job is suddenly untaxed across the board.

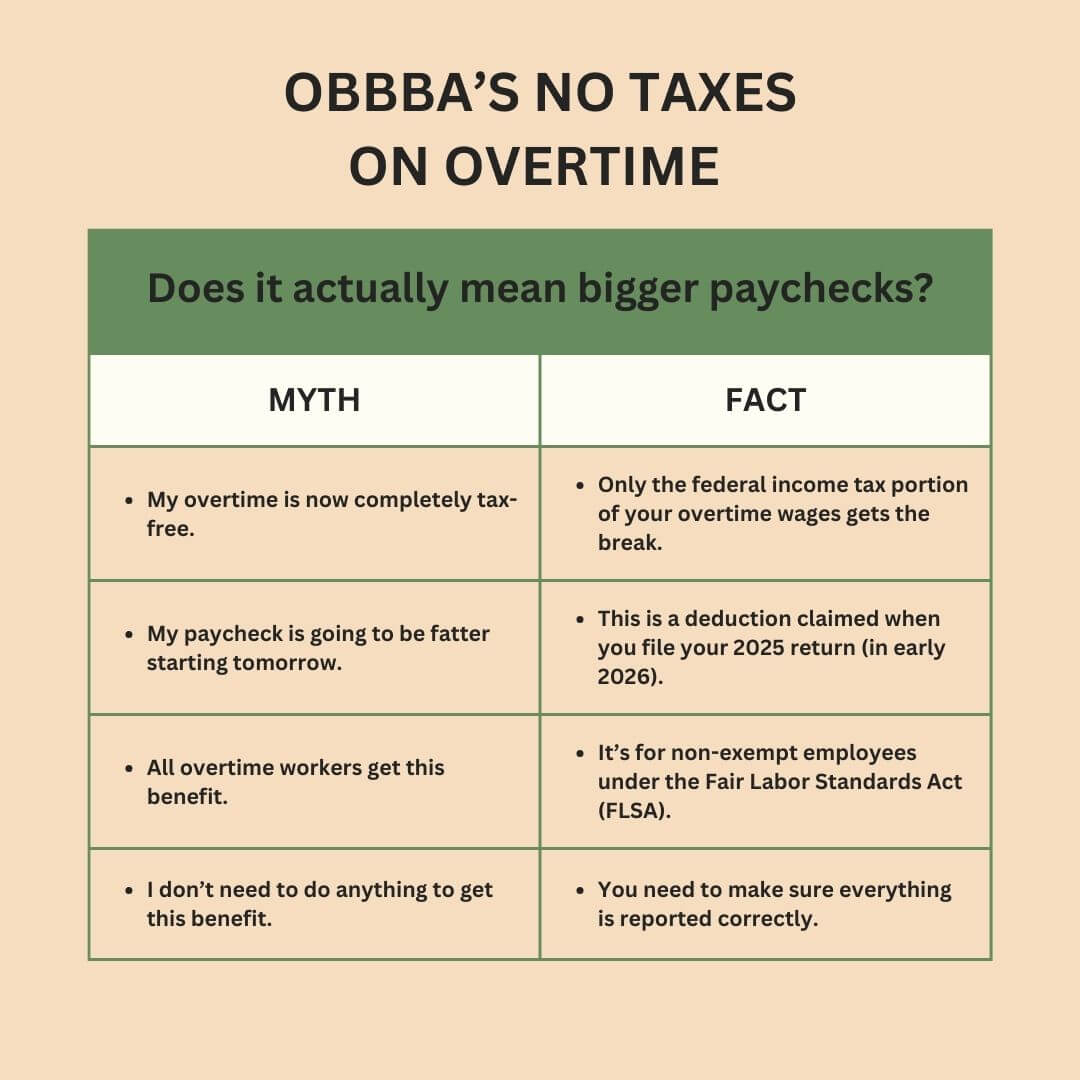

So, let’s cut through the hype and get to real talk. Here are the biggest misconceptions about this rule, one by one.

Is my overtime pay now completely tax-free?

Only the federal income tax portion of your overtime wages gets the break. You still have to account for that 7.65% FICA tax in your paycheck (6.2% to Social Security and 1.45% to Medicare).

And remember: Only the “half-time” premium is deductible from your federal income. For example: if you make $20/hour, making $30/hour overtime, only the extra $10/hour is deductible.

Will I see bigger paychecks right now?

Your paycheck won’t be fatter starting tomorrow.

This is a deduction claimed when you file your 2025 return (in early 2026). You’ll feel it as a larger refund or smaller tax bill.

The IRS is expected to adjust withholding tables in 2026. Your Ceres employer’s payroll system will be updated to automatically account for this deduction, which means you would see less federal income tax withheld from your overtime pay on your paychecks throughout 2026.

Let’s go back to our example. If your deductible “premium” is $10 for each hour of overtime, and you’re in the 22 percent marginal federal tax bracket (for example), each overtime hour will save you $2.20 in federal income tax ($10 premium x 22% tax rate).

Your maximum federal savings from this deduction would be $2,750 for a single filer ($12,500 x 22%) or $5,500 for a married couple filing jointly ($25,000 x 22%).

Do all overtime workers get this benefit?

No. It’s for non-exempt employees under the Fair Labor Standards Act (FLSA).

Think nurses working double shifts, factory workers covering extra production, first responders pulling long weeks, or restaurant and service staff logging 50–60 hours.

Also, note that this is a federal deduction. Your state may still fully tax your overtime.

And be aware that the benefit is only scheduled for tax years 2025–2028… unless Congress extends it.

Do I need to do anything to get this benefit?

Yes, you need to make sure your “qualified overtime compensation” is reported correctly.

Your employer has to label your qualified overtime pay separately on your W-2. If they miss it, you may miss out. So be sure to keep your own pay stubs and track your overtime hours. If there’s a discrepancy, you’ll have the documentation to correct it with your employer or when you file your tax return.

And in 2026, if the IRS does adjust withholding tables, let’s have a catch-up. So we can make sure your withholding is set up to get you bigger paychecks during the year (instead of a bigger refund at filing time).

FAQs

“Does no taxes on overtime apply to salaried employees who sometimes work late?”

No. This benefit is for non-exempt workers under FLSA rules who are paid time-and-a-half for hours over 40.

“What if I earn more than the no taxes on overtime income limit?”

You get the full benefit if your Modified Adjusted Gross Income (MAGI) is below 150K (if you are single) or 300K (if you are married and file jointly). For every extra 1K you earn above the limit, your maximum deduction is reduced by 100.

The benefit is gone completely when your income reaches 275K (single) or 550K (married filing jointly).

“Will my state taxes also exclude overtime?”

Not automatically. State treatment varies on this, so assume you’ll still pay state income tax on all your wages.

“What happens if my employer misreports my overtime?”

You could lose out on the deduction. That’s why it’s critical to keep your own records and double-check your W-2.

“Will the no taxes on overtime deduction get extended past 2028?”

Maybe, but Congress would have to act. For now, plan as if it ends after 2028.

Your Hard Work Deserves This

Your overtime pay is hard-earned money. And recent legislation gives you a chance to keep a bit more of it, but it isn’t your magic “tax-free” ticket.

But we can make sure those long hours translate into maximum savings for you rather than unpleasant surprises at tax filing time.

Email me your hourly rate, typical weekly OT hours, and tax bracket, and I’ll reply with your estimated annual savings and whether to adjust your W-4.